SKU’d Thoughts 45: How are platforms jockeying for the pending U.S. social commerce boom?

Right before I started my online search for faux plants, my wife shouted out a set of prerequisites: “Read the reviews first”, “See if there are any reviews that include an actual picture” “Make sure some reviewers say it looks real”. She essentially wanted me to validate the pending purchase through social proof, a key feature in social commerce.

How it started

Yahoo first started using the phrase “social commerce” back in 2005 with its introduction of collaborative shopping tools that let shoppers create, discover, and share product information. The phrase was ahead of its time since the infrastructure and consumer behavior needed to accommodate a social commerce experience weren’t aligned back then. In 2005, social media sites like Facebook and Tumblr were just in their infancy and online shopping was just beginning to pick up steam with 25% year-over-year growth.

Fast forward to the present, half of the world’s population uses social media, and shopping online is no longer a novelty, both realities which set the stage for a seamless social commerce experience. Social media platforms need to facilitate commerce and consumers need to see social media as an avenue for making purchases. For this to happen, a few things need to fall in place. From the social media side, platforms have to enable 1) product discovery, 2) social validation, and 3) product checkout, while three consumer behaviors need to mature — 1) shopping via e-commerce 2) validating via socials, and 3) consuming mobile-first.

China leads the way

In China, all three consumer behaviors have already converged. 74% of the country’s population shops online via mobile, 20% of the population is Gen Z, the first generation truly native to mobile, and 79% of Chinese citizens are active on social media. So it’s no surprise that China’s social commerce sales are projected to hit ~$242B in 2020 (~12% of the country’s e-commerce) and expected to almost double by 2023. On the infrastructure side, in 2017, WeChat, China’s premier social media and messaging app with over 1 billion monthly active users launched “Mini Programs”, which gave users the ability to launch online stores. The frictionless nature of Mini Programs allows users to discover and purchase products without being redirected out of the WeChat app. Since its launch, there have been over 2 million Mini Programs, and e-commerce ranks as one of the most used categories.

Another indicator of China’s lead in social commerce is Pinduoduo. The 5-year old mobile-first marketplace, which started as a Mini Program on WeChat, is China’s second-largest (by users and order volume) online marketplace and has a market cap of $176B, as of November 2020. Pinduoduo has thrived around the concept of social engagement by building community with its unique “team purchase” business model. This allows shoppers to buy products individually and to initiate or join a team purchase to get lower prices. This model incentivizes customers to share products with their social network which drives up order volumes for merchants.

The potential for a U.S. social commerce boom

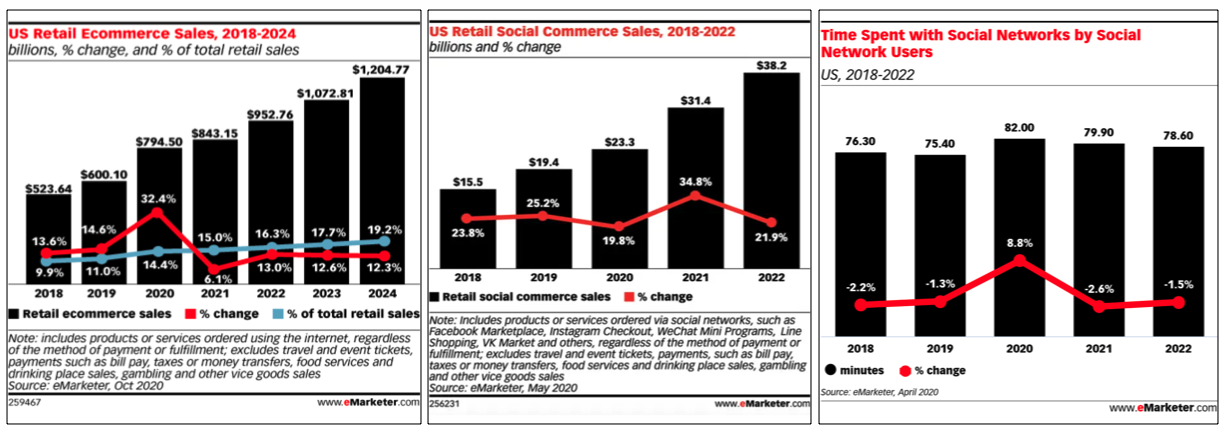

With its high maturity in infrastructure and consumer behavior, China’s social commerce far outpaces the U.S. by more than 10 times ($23B vs $243B). During the U.S. stay-at-home period of the pandemic, consumers had to quickly get comfortable with buying online. As a result, 2020 e-commerce sales are expected to hit $794B but social commerce is still less than 3% (compared to China’s 12%) of these projections. However, with an increase in how much time people spend on social media, companies are incentivized to invest in commerce infrastructures that will enable a social commerce boom in the U.S.

Companies positioning for a share of U.S. social commerce

Facebook, Instagram & WhatsApp

Facebook, the social media conglomerate, has slowly been inching towards social commerce dominance in the U.S. The nature of its core products, Facebook and Instagram, lends itself to commerce; users can easily do a virtual garage sale by simply posting a picture with a “for sale” caption. Over the years, the company has taken steps to make it even easier to sell and buy on their platforms. In 2016, Facebook launched Marketplace, its version of Craigslist that allows users to utilize the app for local transactions. It has since ramped up commerce efforts by introducing Checkout on Instagram, a feature that allows customers to make purchases without leaving the app. During the pandemic, it added Facebook Shop and Instagram Shop to its commerce suite. The shops serve as dedicated places on the apps for consumers to discover and make purchases. Instagram’s Reels, the app’s copycat of TikTok, is also getting a shoppable infusion. Reels can have tagged products that enable users to buy, save, or learn more about those products. Facebook has also taken a cue from QVC by adding Live Shopping, a feature that enables merchants to live stream and show off products that customers can buy directly through the stream on either Facebook or Instagram.

Similarly to messaging apps in China, Facebook is giving customers the ability to view and share products with their social networks through their suite of messengers (Messenger, WhatsApp or Instagram Direct) before making a purchase. Borrowing from what WeChat has done with commerce and messaging, Facebook will leverage its messaging app, WhatsApp, to expand the ways users check out products in Facebook Shops. As if all of these product expansions didn’t already signal Facebook’s bullishness on social commerce, the company has also done a major overhaul of its app's user-facing designs to promptly display commerce features.

Amazon & Twitch

Social commerce is a subset of e-commerce, so naturally, Amazon, the largest e-commerce player, would attempt to play a part. In 2017, the company launched Amazon Spark, an Instagram-like shoppable feed of stories and photos aimed at Amazon Prime members. But it was shut down in 2019 and replaced with Amazon Posts and Amazon Live. Amazon Posts allow brands to create yet another Instagram-like feed of their products on Amazon that links to their product listings while Live features live video shows from brands and influencers talking about and demonstrating products available on Amazon. These attempts have fallen flat but considering half of all e-commerce product searches begin on Amazon, the company is likely to strike gold.

One of Amazon’s subsidiaries, Twitch, is also positioned to grab a share of social commerce. The video game streaming platform enables nearly 40 million monthly viewers in the U.S. to watch gamers and could potentially activate commerce. In 2019, Twitch partnered with an e-commerce swag platform, Teespring, to enable audiences to buy their favorite gamers’ merch without leaving Twitch’s stream page. In previous years, brands like Hershey and Axe have launched Twitch campaigns to promote products so the potential for allowing in-platform checkout would open up the streaming site as a formidable marketplace.

Snapchat

Since its launch in 2011, Snapchat has had a demographic advantage in the U.S. A semi-annual “Taking Stock with Teens” survey by Piper Sandler revealed that 34% of teens ranked Snapchat as their favorite social media platform. The app has high penetration with this demographic because of consistent product innovation, such as ephemeral messaging which has been adopted by most major social platforms. The affinity from Gen Zers and the company’s propensity for product innovation positions it to gain traction in social commerce. Snapchat plans to use augmented reality (AR) to digitally immerse users in experiences that were once only available in the offline world, like testing out cosmetics. The platform already teamed up with Gucci to let users virtually try on shoes with an enabled “shop now” button that makes products available for immediate purchase.

TikTok

That same Piper Sandler’s survey also shows TikTok, the video-sharing app, is quickly increasing penetration with Gen Z users. The app surpassed Instagram as the number two preferred social media app among teens with a 29% share. TikTok’s potential importance to commerce can be gleaned from the interest Walmart has shown in proposing to buy a piece of the company. It’s offered to provide e-commerce, fulfillment, payments, and other omnichannel services to the platform. The app has also partneredwith Shopify to enable merchants to create shoppable video ads that drive customers to online stores. With TikTok’s 80 million monthly active users, 60% of whom are Gen Zers, and potential commerce support from Walmart, the app will most likely garner the attention of brands looking for diversified distribution channels to reach Gen Z consumers.

One social media platform that is well-aligned with the product discovery and social validation variables of social commerce is Pinterest. The photo-sharing and discovery platform is a destination for users in search of creative and aspirational products. The company has introduced new ways to shop that keeps users within the platform for the entire shopping journey. For smaller brands, this is also a major benefit since 97% of searches on the platform are unbranded. Pinterest hopes to win share in social commerce by continuing to be a destination for aspirational products and services.

Google & YouTube

Not to be left out of the social commerce mix, Google recently launched two mobile two shopping features. An AR-powered cosmetics try-on experience with top brands like L’Oréal and Estée Lauder that allows consumers to try on makeup shades. The search engine also released a feature, that would provide video recommendations from experts and enthusiasts for apparel, home, and beauty item discovery. Prior to these updates, Alphabet, Google’s parent company, already signaled the importance of commerce to its business with key improvements to one of its other subsidiaries, YouTube.

The world’s second-most popular website announced a new shoppable ad format. The new ad system will allow for tagging products in videos to make them shoppable. With nearly 2.4 billion monthly users, the platform is a predictable destination for influencers and brands. According to a Google Survey, 40% of global shoppers have purchased products they discovered on YouTube. Sundar Pichai, YouTube’s parent company CEO has described the site as “an important platform for e-commerce” and has inferred that the multitude of product videos could be turned into a shopping opportunity and a formidable marketplace.

And then there’s Twitter. In 2014, it launched a “buy” button to facilitate commerce within the app but later dropped the feature. Although Twitter no longer directly dabbles in social commerce, the microblogging platform has been well-positioned to be a conduit for brands seeking social validation. A perfect example of this is Nike’s SNKRS app and its Saturday morning sneaker drops. Regardless of the outcome for sneakerheads, they often turn to Twitter to share a screenshot or bemoan how they have the worst luck in the world. Twitter is an enabler for this post-purchase engagement which I suspect drives more people to the app. The Nike SNKRS app is also an example of how brands can build their own social commerce platforms.

What’s next?

Beyond social media companies poised to grow topline and launch new verticals, marketplaces like Shopify also stand to gain from the U.S. commerce revolution in the U.S. by providing the commerce engine that social media platforms need. In the last few years, a crop of ambitious startups, like Popshop Live and Verishop, broke into the social commerce space. However, they are at a significant disadvantage since more established platforms have large user bases that took, in some cases, decades to amass. To be fair, startups are often fearless and more in tune with a specific customer set so I can see these upstarts making headway in the space and fueling M&A interest from brands and or social media platforms.